FINANCE CONSULTING AGENCY

Empowering individuals, businesses, and organizations to achieve financial stability, growth, and success through expert guidance, innovative solutions, and personalized service.

Comprehensive Approach Financial Planning

Cash Flow Management

Experienced Professional Investment Advice

A Professional & Personalized Level of Care

At streamtrading, we’re a team of seasoned finance experts dedicated to helping individuals, businesses, and organizations achieve their financial goals. With a passion for delivering personalized service and innovative solutions, we provide expert guidance and support to navigate complex financial landscapes. Our mission is to empower our clients with the knowledge, tools, and confidence to make informed financial decisions and shape a more prosperous future.

To be a trusted leader in finance consulting, delivering exceptional value to clients and helping them navigate complex financial landscapes with confidence and clarity, ultimately shaping a more prosperous future for all.

Convenient Access to Expert Advice

Effective tax planning can help you minimize liabilities, maximize savings, and achieve your financial goals. Our expert tax planning services include:

– Tax Strategy Development: Customized plans to optimize your tax position

– Tax Savings Identification: Opportunities to reduce tax liabilities and increase refunds

– Compliance: Ensuring accurate and timely tax filings

– Tax Implications Analysis: Guidance on tax implications for business and investment decisions

Comprehensive financial planning helps you achieve stability, security, and success. Our expert services include:

– Goal Setting: Identifying and prioritizing financial objectives

– Budgeting: Creating personalized budgets to manage income and expenses

– Investment Planning: Strategies for growth, income, and risk management

– Retirement Planning: Building a secure financial future

– Risk Management: Protecting assets and income with insurance solutions

Effective asset management helps you optimize your investments, manage risk, and achieve your financial goals. Our expert services include:

– Portfolio Management: Customized investment strategies tailored to your objectives

– Asset Allocation: Diversifying investments to balance risk and returns

– Investment Selection: Identifying opportunities for growth and income

– Risk Management: Mitigating potential losses and protecting assets

– Performance Monitoring: Regular reviews to ensure alignment with your goals

As a trusted investment advisor, we provide personalized guidance to help you achieve your financial goals. Our services include:

– Investment Strategy Development: Tailored plans aligned with your objectives

– Portfolio Management: Active management of your investments

– Market Insights: Timely updates on market trends and opportunities

– Risk Assessment: Identifying and mitigating potential risks

– Performance Monitoring: Regular reviews to ensure alignment with your goals

Let us help you navigate the complexities of investing and make informed decisions to achieve your financial aspirations.

Secure your future with a personalized retirement plan. Our expert services include:

– Retirement Goal Setting: Defining your vision and objectives

– Financial Assessment: Evaluating your current financial situation

– Investment Strategies: Building a portfolio to support your retirement goals

– Income Planning: Creating a sustainable income stream

– Risk Management: Protecting your retirement savings

Let us help you create a tailored retirement plan to ensure a comfortable and fulfilling post-work life.

Effective cash flow management is crucial for financial stability and success. Our expert services include:

– Cash Flow Analysis: Understanding your income and expenses

– Budgeting: Creating a personalized budget to manage cash flow

– Forecasting: Predicting future cash flow needs

– Optimization Strategies: Identifying opportunities to improve cash flow

– Risk Management: Mitigating potential cash flow disruptions

Let us help you master your cash flow and achieve financial peace of mind.

Professional Team Ready

Our expertise encompasses a broad range of skills and knowledge that enable us to deliver high-impact solutions. Here’s an overview of our areas of expertise:

– Financial Services

– Data Analysis and Strategy

– Digital Transformation

– Risk Management

Our team of experts is dedicated to delivering tailored solutions that drive innovation, advancement, and societal impact.

We foster strong partnerships with industry, provide support and expertise, and transform ideas into tangible outcomes. With our expertise, we help organizations define their gender strategy, develop gender-intentional products and services, and increase access to digital financial services for underserved groups

Private Asset

Private Cash Flow

Monthly Events

Easy Approach

Unlock Possibility

Award & Reward

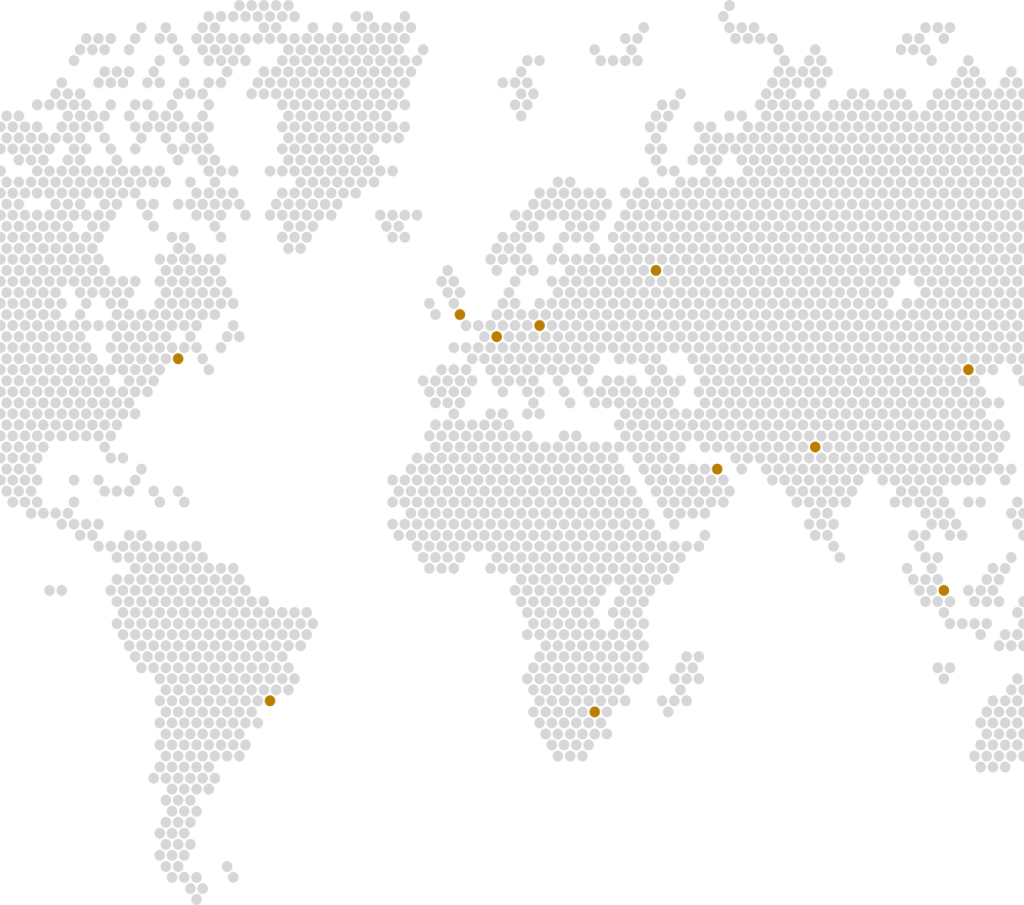

Our Well-Known Branch Is Spread In All Over The World

Easy To Contact Us

Expert Advisor

Live Support

Frequently asked questions

Our team is adaptable and can work with clients across various industries, providing tailored financial guidance and support.

Our financial analysis process typically involves:

1. Data Collection: Gathering relevant financial data, such as income statements, balance sheets, and cash flow statements.

2. Ratio Analysis: Calculating key financial ratios to assess performance, liquidity, profitability, and efficiency.

3. Trend Analysis: Identifying patterns and trends in financial data over time.

4. Industry Comparison: Benchmarking against industry averages and peers.

5. Financial Modeling: Creating models to forecast future financial performance.

6. Risk Assessment: Identifying potential financial risks and opportunities.

This comprehensive approach enables us to provide actionable insights and recommendations to support informed decision-making

Our consultants have extensive experience in finance, accounting, and business advisory, with expertise in:

1. Financial planning and analysis

2. Investment analysis and portfolio management

3. Risk management and mitigation

4. Mergers and acquisitions

5. Financial modeling and forecasting

Many of our consultants hold advanced degrees and professional certifications, such as:

1. CFA (Chartered Financial Analyst)

2. CPA (Certified Public Accountant)

3. MBA (Master of Business Administration)

Our team has worked with various clients across different industries, providing tailored financial guidance and support. We’re committed to delivering high-quality services and helping clients achieve their financial goals.

We stay current with industry developments through:

1. Continuous Professional Development: Regular training and certifications.

2. Industry Events: Attending conferences, seminars, and workshops.

3. Publications and Research: Reading industry journals, reports, and articles.

4. Networking: Engaging with professionals and thought leaders.

5. Online Resources: Utilizing webinars, podcasts, and online courses.

This enables us to provide clients with informed guidance and stay ahead of industry trends.

We communicate with clients through:

1. Regular Meetings: In-person or virtual meetings to discuss progress and goals.

2. Phone and Video Calls: Timely responses to questions and concerns.

3. Email Updates: Clear and concise communication on project status.

4. Secure Online Portals: Sharing documents and information.

5. Collaborative Tools: Utilizing platforms for seamless communication.

We tailor our communication approach to meet each client’s unique needs and preferences, ensuring transparency and trust throughout our partnership.

We offer:

During the Engagement:

1. Regular Progress Updates: Keeping you informed on project status.

2. Timely Responses: Addressing questions and concerns promptly.

3. Collaborative Approach: Working closely with your team.

After the Engagement:

1. Ongoing Support: Availability for follow-up questions.

2. Implementation Assistance: Helping with recommended changes.

3. Periodic Reviews: Checking in to ensure continued progress.

Our goal is to provide exceptional support throughout our partnership, ensuring you achieve your financial objectives.

We ensure client confidentiality through:

1. Non-Disclosure Agreements (NDAs): Signing NDAs to protect sensitive information.

2. Secure Data Storage: Utilizing encrypted and secure systems.

3. Access Controls: Limiting access to authorized personnel.

4. Confidentiality Policies: Strict policies governing employee conduct.

5. Secure Communication: Using encrypted channels for sensitive information.

We prioritize client confidentiality and adhere to industry standards to safeguard your sensitive information.